Prices of Battery Materials In 2018 – Spheronized graphite, the only one to rise

23 January 2019 -

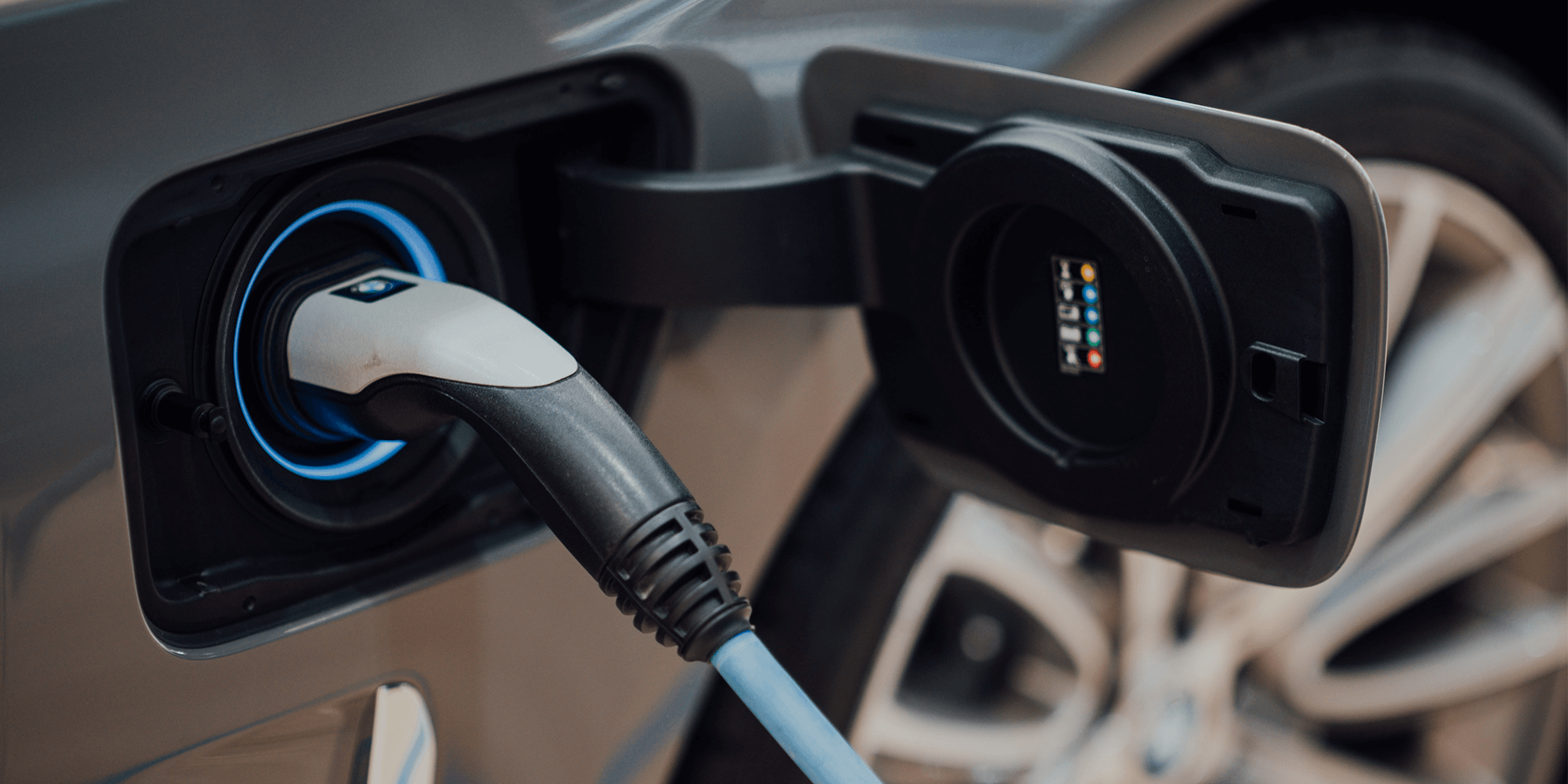

Throughout 2018, we have seen a continuation of the excellent news related to the sales of electrics vehicle, to the deployment of energy storage systems and to the production of lithium-ion batteries. The official sales figures for EVs and plug-in hybrids are not yet published (insideevs.com) but indications are that they will exceed 2 million units worldwide (the majority being pure electric). Growth in energy storage systems has accelerated with ever larger projects. For example, Tesla has been working on a 1 GWh storage project in California. To our knowledge, it is the first time that a single energy storage project is planned to reach GWh. To give you an idea of how big 1 GWh is, that would be enough batteries to produce 16,000 mid-range Tesla Model 3s.

While global lithium-ion battery production capacity has risen to over 150 GWh during the course of the year, this capacity is only a fraction of what it is expected to be in 10 years. As we are writing this, London’s Benchmark Minerals Intelligence (BMI) forecasts that production capacity of lithium-ion could reach 1.45 TWh (1450 GWh) if all of those 68 mega-factories that are announced or in the process of expansion / construction are realized.

So, all throughout the year, very positive news on industries that produce and consume lithium-ion batteries which constitute the fundamental of an investment in the energy transition via battery materials. Despite this, sentiment in the market turned negative in early 2018. All prices for the key raw materials used to manufacture lithium-ion batteries fell in 2018 except for graphite. Spheronized graphite has appreciated by 15% during the year according to Fastmarkets while BMI speaks rather of increases of 20% to 26% between grades of 10, 15 and 25 micron. This increase is due to rising demand from producers of anode material.

In terms of Chinese exports of spheronized graphite, BMI reported a 39% increase during its December monthly update, also due to strong demand from anode material producers located in Japan and South Korea. Finally, with regard to the prices of flakes, Fastmarkets and BMI agree that they remained stable throughout the year.

Fastmarkets article (Mining Industry Specialists): https://www.metalbulletin.com/Article/3850557/2018-REVIEW-10-things-that-defined-the-battery-raw-materials-markets-this-year.html